What is Mi Credit? How to Use It?

After revamping the smartphones, TVs and other electronics industry, Xiaomi has stepped into the financial sector with the services like – Mi Pay and Mi Credit. Mi Pay is a UPA based payment system and Mi Credit is a credit lending service which is available from the last September to the selected MIUI users, but now it’s available for all the Xiaomi users.

This credited service allows users to borrow personal loan up to 1 lack rupees instantly to their bank accounts. If you are intruded about this financial service of Xiaomi, then you will be pleased to know that we are going to understand this service in-depth with the method to use it.

Source – Mi Community

What is Mi Credit?

Mi Xiaomi credit is a type of personal finance loan where user can take a loan through their mobile phones and payback in small monthly installments. It is similar to the traditional bank loan procedure, but this is entirely a digital process and the loan disbursement is instant. The main highlighters of the credit service offered by Xiaomi are –

1. It is a secure and instant way to get a personal loan sanctioned.

2. It is available for all the Xiaomi users who are running MIUI.

3. User can get the loan up to 1 rupee in the real-time.

4. The interest rates vary from 1.3%-2.5% per month and the maximum loan tenure is 36 months.

5. To get the loan, the user needs to provide PAN, address proof, income source, and bank details.

6. The EMI for a loan should be paid by 5th of every month without delay.

7. It is going to be a collateral-free loan that means you won’t have to show any kind of security in the terms of property to get the loan. However, you have to pay a certain processing fee to get the loan.

How To Use Mi Credit?

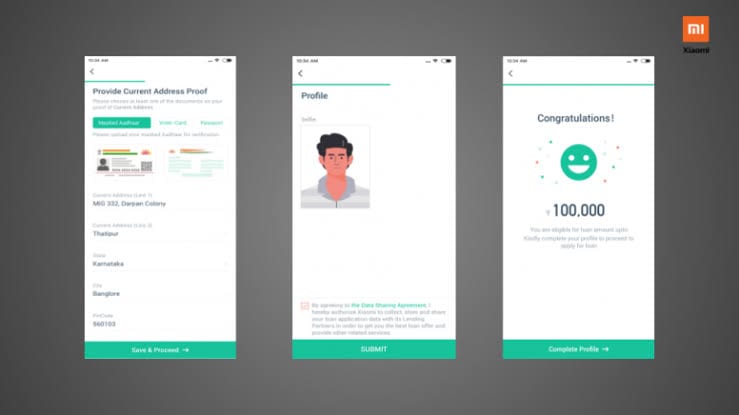

Source – Mi Community

If you want to get a quick loan for some emergency, then this Xiaomi Service is going to be very helpful for you. However, if you haven’t used this service before and struggling to use the app, then you can follow these easy steps.

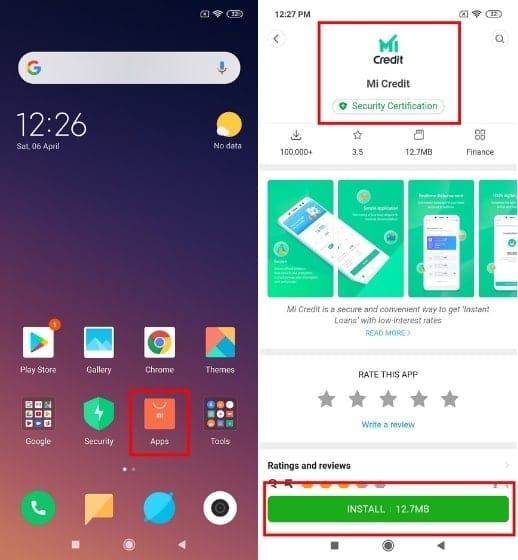

Step 1. On your Xiaomi smartphone, you should open your Mi Apps icon by tapping over it and search for the Mi Credit app and press on install.

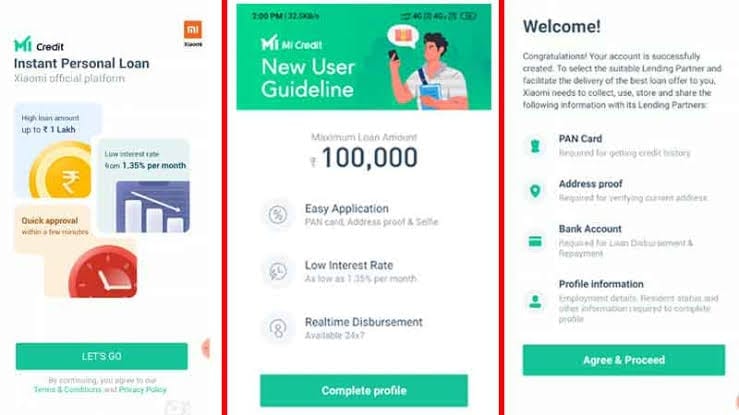

Step 2. Now, run the app on your device and go through the welcome screen after granting permission to the app.

Step 3. On the very next screen, you have to tap on the Get Now option and enter your mobile phone number and after that, you will receive an OTP number which you have to enter in lieu to start the app.

Source – Beeboom

Step 4. Next, you have to insert a digital copy of your financial documents. Foremost, you have to scan your PAN document and enter your details. After, that you have to scan your address proof and enter your address proof document.

Step 5. Lastly, you have to click your one selfie with your Xiaomi device and then press on proceed. Now, your loan profile has been created and will take a few minutes to check your eligibility status.

Step 6. If you are fortunate enough and your papers are correct, then you will get eligibility status and up next you have to provide more documents like your bank account statement and salary details. After that, you will be able to initiate the disbursement directly to your bank account. However, one time if you fail to find loan eligibility, then after 60 days you can reapply.

Comparison with Other Instant Personal Loan Services

Source – Vijay Solution

This is a very new credit service and its main target are only MIUI users, on the other hand, the Indian market is swamped with numerous other instant personal loan services such as Indiabulls Dhani, KreditBee, and LazyPay are the few leading services. If we compare other loan services with the service in our hand, then we can find the following differences –

Credit Availability – Xiaomi personal loan service is available only to MIUI users which is a small part of android users. It is a tough nut to crack as its user based is closed off. There are plenty of different digital lenders available that’s why it is good for Xiaomi to increase its service base.

Interest Rates – If we discuss the monthly interest rates, then we can say that it has a better interest rate than any of the leading competitors. The interest of Xiaomi credit service starts from with 1.3% to 2.5% interest rates with 36 months of tenure. Nonetheless, Xiaomi has to fight the competition to maintain a low processing fee, and better customer service to create a loyal customer base.

Integration – Today, it is very important for financial services to easily integrate with other services like food delivery, taxi, and shopping. But, unfortunately, Xiaomi credit service won’t offer integration with other services. However, MIUI users expect that Xiao mi will work on the app integration in the future and introduce some major changes in the app.

Also Read: How to Download Apps Not Available in Your Country on Android and iPhone

Are you Excited to Use Mi Credit?

Xiaomi credit service is an amazing product and it has huge potential to help out the people who need monetary help instantly. The interest rates offered by Xiaomi are as per the industry standards, but the improved customer service and no hidden charges make it the most accessible instant personal loan services. Currently, Xiaomi is understanding the requirements and need of middle-class users better than any other service provider.

We truly hope that in the future, Xiaomi will continue to push their boundaries and will design some more consumer-oriented electronic products. So, we hope that after reading – what is Mi credit and how to use Mi credit? You are ready to try your luck with this app and instantly loan to fulfill your dreams.

If you have used this financial service or planning to use, then please share your experience and queries in the below-given comment box.

Popular Post

Recent Post

How to Troubleshoot Xbox Game Bar Windows 10: 8 Solutions

Learn how to troubleshoot and fix issues with the Xbox Game Bar not working on Windows 10. This comprehensive guide provides 8 proven solutions to resolve common problems.

How To Record A Game Clip On Your PC With Game Bar Site

Learn how to easily record smooth, high-quality game clips on Windows 11 using the built-in Xbox Game Bar. This comprehensive guide covers enabling, and recording Game Bar on PC.

Top 10 Bass Booster & Equalizer for Android in 2024

Overview If you want to enjoy high-fidelity music play with bass booster and music equalizer, then you should try best Android equalizer & bass booster apps. While a lot of these apps are available online, here we have tested and reviewed 5 best apps you should use. It will help you improve music, audio, and […]

10 Best Video Player for Windows 11/10/8/7 (Free & Paid) in 2024

The advanced video players for Windows are designed to support high quality videos while option to stream content on various sites. These powerful tools support most file formats with support to audio and video files. In this article, we have tested & reviewed some of the best videos player for Windows. 10 Best Videos Player […]

11 Best Call Recording Apps for Android in 2024

Whether you want to record an important business meeting or interview call, you can easily do that using a call recording app. Android users have multiple great options too. Due to Android’s better connectivity with third-party resources, it is easy to record and manage call recordings on an Android device. However it is always good […]

10 Best iPhone and iPad Cleaner Apps of 2024

Agree or not, our iPhones and iPads have seamlessly integrated into our lives as essential companions, safeguarding our precious memories, sensitive information, and crucial apps. However, with constant use, these devices can accumulate a substantial amount of clutter, leading to sluggish performance, dwindling storage space, and frustration. Fortunately, the app ecosystem has responded with a […]

10 Free Best Barcode Scanner for Android in 2024

In our digital world, scanning barcodes and QR codes has become second nature. Whether you’re tracking packages, accessing information, or making payments, these little codes have made our lives incredibly convenient. But with so many barcode scanner apps out there for Android, choosing the right one can be overwhelming. That’s where this guide comes in! […]

11 Best Duplicate Contacts Remover Apps for iPhone in 2024

Your search for the best duplicate contacts remover apps for iPhone ends here. Let’s review some advanced free and premium apps you should try in 2024.

How To Unsubscribe From Emails On Gmail In Bulk – Mass Unsubscribe Gmail

Need to clean up your cluttered Gmail inbox? This guide covers how to mass unsubscribe from emails in Gmail using simple built-in tools. Learn the best practices today!

7 Best Free Methods to Recover Data in Windows

Lost your data on Windows PC? Here are the 5 best methods to recover your data on a Windows Computer.