Is the Bitcoin Market Manipulated?

With the internet opening up a world of possibilities, the concept of having a digital currency was bound to surface. Having taken ten years to become an actual thing, Bitcoin is the talk of the town today. Everyone from college grads sitting in their garages to wall street giants trade in Bitcoin.

Bitcoin or BTC is a form of decentralized peer-to-peer currency. The system is regulated by its users and a distributed network public database technology named blockchain is used to store, issue, and transact the currency.

Whether you mine bitcoin or trading Bitcoin from a bitcoin exchange, the best feature about this virtual currency is there is a controlled supply element to its code that is the number of bitcoin’s existence will never exceed 21 million. The reason behind this particular number is that it is approximately relative to the rate at which natural resource commodities (such as gold and silver) are mined. This controlled supply in turn offers a protection against many objectionable qualities that come with government and central bank intervention into traditional fiat currency transactions.

Is Bitcoin price manipulated?

Bitcoin was introduced to get above and far from market manipulations. Besides, the founder/s ensured this by using decentralization technology. But for some time now, especially after the 2017 bitcoin price surge, speculations have surfaced about manipulations in the crypto currency market.Market manipulation ensues when one tries to meddle with the market and makes synthetic, inaccurate or misleading representations of any currency. This isn’t a new phenomenon. Manipulations in stock or economy markets is an old thing but reports of manipulations in the crypto market sounds like mere speculations for it seems like a difficult feat.

A lot of reports have surfaced about Bitcoin’s manipulation since it came into the spotlight as usually happens when something new storms the market. What follows such speculations is probes in the matter and people believing the theories. However, for the argument’s sake let’s try to understand this conjecture with an example. A man sells and distributes tomatoes in a small town, and he manages 60% of the supply. Now if he wants to hike the price of the commodity, he simply has to control the supply for supply of any commodity controls the price everywhere.

Similarly, if someone decides to control the supply of Bitcoin, the price of it will go up and if the supply is increased then its price will drop. But the bitcoin exchanges have displayed in the past that a large amount of the currency is not required to control the price flow.

With Bitcoin however, it is impossible to hold in one hand such huge amount of Bitcoin. So, if there is one thing that could indeed control the price of it is unity. If everyone who owns a bitcoin decides and agrees to exchange bitcoin for one single price, instantly, a fence will be created that will control the price of the Bitcoin to go lower than the decided price. This way, the bitcoin’s price can be manipulated.

Now, if one plans of analyzing the prices and reports regarding bitcoin and declares that the prices are indeed manipulated, it should go without mentioning that these charts talk only about the sellers and consumers of this cryptocurrency. Whereas, the highs and lows of bitcoin are managed by trading bots. “The Trading bots are nothing but automated programs for trading strategies. These bots don’t do anything else. They simply watch the trading edicts inscribed in a programming language.” This simply means that if bitcoin is purchased more, then its price will go up and vice-versa.

The report on manipulation

In 2018, John Griffin, a finance professor at the University of Texas, and graduate student Amin Shams analyzed blockchain purchases and discovered that major Tether (a digital currency tied to the US dollar) buys were timed to follow market downturns and helped stabilize bitcoin’s floor. They published a paper on the same and the manipulation in the crypto market has since been questioned.

“Our results suggest instead of thousands of investors moving the price of Bitcoin, it’s just one large one,” Griffin said in an interview. “Years from now, people will be surprised to learn investors handed over billions to people they didn’t know and who faced little oversight.”

When Tether was asked about these allegations, their General Counsel, Stuart Hoegnerargued that the paper is “foundationally flawed” as it is not backed by sufficient data.

The claims made by Griffin and Shams is based on the theory that new Tethers are created without the $1 to back each Tether and then used to buy Bitcoin, leading to rising prices. The authors examined Tether and Bitcoin transactions from March 1, 2017 to March 31, 2018, concluding that Bitcoin purchases on Bitfinex increased whenever Bitcoin’s value fell by certain increments. They shared their research with Bloomberg News.

Subpoenas were sent to both Bitfinex and Tether in 2017 from the U.S. Commodity Futures Trading Commission. The Justice Department opened a criminal investigation to find if Tether was being used to manipulate Bitcoin. But so far, neither the CFTC nor federal U.S. prosecutors have accused Bitfinex or Tether of any misconduct.

The indictment

The Justice Department however has not forgotten their probe into the matter. Just a few weeks back on June 3rd, a New York prosecutor published an indictment and claimed that BitFinex and Tether indeed manipulated the Bitcoin price and other Bitcoin exchanges are said to have been involved as well.

The indictment claims that Tether, the company that created USDT, represented to the market that every USDT in circulation was backed by a U.S. dollar in Tether’s bank account, and that holders could exchange their USDT for those dollars anytime they wished. USDT was thus held out as the digital equivalent of U.S. dollars. They further call it an audacious lie.

Further, Tether issued billions of USDT to itself with no U.S. dollar backing and hence, simply created the USDT out of thin air. The newly issued USDT were sold to Bitfinex, which was essentially owned by the same group that owned Tether and because Bitfinex and Tether were basically the same, Tether just transferred the newly issued USDT into its account on Bitfinex without receiving any U.S. dollars in exchange, which was required from real customers.

The indictment additionally claims that the lie that one USDT equaled one U.S. dollar seemed believable and so, the market interpreted these massive purchases as reflecting meaningful consumer demand for crypto commodities. This in turn prevented the prices of these commodities from falling and the same purchases that converted the USDT that Bitfinex and Tether had fraudulently created for free into valuable crypto commodities also artificially inflated the value of those commodities. Bitfinex and Tether then apparently trades those crypto commodities for other assets whose value was not inflated, including by selling them for U.S. dollars.

The complaint states that the “Defendants’ manipulative purchases caused prices to skyrocket. They claim that people bought Bitcoin and other crypto currencies like Litecoin and Ether at artificially inflated prices and paid far more than the actual prices of the currencies would have been had the prices were not manipulated. But the balloon couldn’t be filled after a certain point and by December 2018, the price of bitcoin plummeted. It came down to mere $3,500 from a colossal $20,000 when the defendants manipulated the price. $450 billion of value just proofed in the air in less than a year. It wasn’t just Bitcoin though, Ether and Litecoin suffered a similar fate when they got devalued to almost 80% by the end of 2018.

Since then, new revelations keep surfacing about the questionable approach of the crypto companies. Basically, originally there was chatter of misappropriated money of $ 850 million. But an amendment to the lawsuit that was filed on October 6 was about an exorbitant sum of $ 1.4 trillion. That is what the public prosecutor quantifies the damage to be that the sister companies have done to the crypto market. The prosecutor claims that this could be the sole reason for the 2017 surge in bitcoin process. However, if the claims of bitcoin price manipulation are proved, the results could be catastrophic.

Conclusion

No proof of USDT to being 1-to-1 secured with US dollars has come from Tether or their balance sheet yet. It is indeed possible to manipulate bitcoin but we will know this for a fact only after the lawsuit comes to end. Interestingly however, before the lawsuit began, Bitfinex and Tether admitted that they “fully expect” to be sued.

Popular Post

Recent Post

Best Y2mate Alternatives- A Comprehensive List In 2024

Videos are one of the most popular media types among consumers currently, for posting promotional or informative content. This is why YouTube has one of the biggest user-bases currently, and people search for tools to easily download these files. However, YouTube features a strong algorithm and legal guidelines that stop people from downloading or using […]

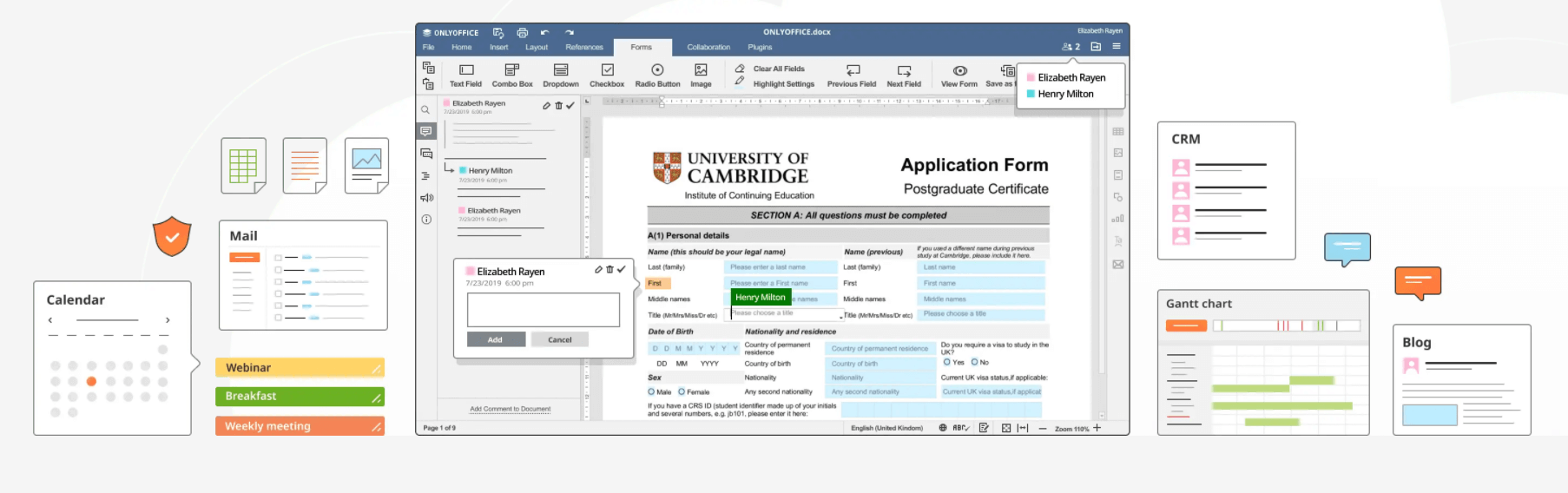

Availability of ONLYOFFICE Docs v.7.0- Latest Version Comes with More Modifications

ONLYOFFICE delivers the newest Docs v.7.0 with additional features, new upgrades, and a host of revisions for professional collaboration uses. Having a high-quality feature-rich office suite invigorates the productivity rate of companies, professionals, and even homeowners. ONLYOFFICE developers have therefore come up with the latest version of the DOCS online office suite. The version boasts […]

Review: Status Saver For WhatsApp 2024 [Free]

Ever since WhatsApp launched its own Status feature, people are loving it. As we can add interesting images and videos to our WhatsApp Status to show it to others and also watch others’ status. But the problem often faced by the users is that WhatsApp does not have a Status saver option. So what do […]

5 Cybersecurity Tips To Manage Your Remote Personnel Challenges

Did you know that your company’s information can unintentionally be put at risk by you and your employees when working remotely? This could possibly lead to fraud, data breaches, and a plethora of other unwanted consequences. Although remote working offers many benefits, it also comes with some risks. Continue reading if you want to learn […]

What is FileRepMalware & How to Remove It?

For the continued safety of the digital system and files, many people download a third-party antivirus program into their device. These keep the system safe from security issues after an intricate scanning process. Windows devices can install options like Norton, Avast, or AVG for quick and efficient malware/virus detection. In many cases, the tag FileRepMalware […]

SaaS Growth in 2022: Growth, Challenges, and Strategies

Software-as-a-Service (SaaS) is expanding very quickly in the entire IT business. SaaS models are the first preferences of many enterprises because of their flexibility, cost-effectiveness and subscription-based model. In the pandemic, companies required the cloud network; thus, SaaS has only got growth and will be growing. Gartner and BMC have given highly optimized reports, according […]

M1 Pro vs. M1 Max: Which Is The Better Mac Chip

In 2020, Apple’s M1 chip debuted and blew us all away with how much it improved performance and efficiency in the MacBook Air M1, Mac Mini M1, and MacBook Pro M1. Mac users were still on the M1 performance hangover when Apple launched M1 Pro and M1 Max with better performance promise. Both chips are […]

Apple Pay Not Working! Here’s How to Fix It (10 Fixes)

Today, people are more and more relying upon digital payments because they are safe and fast. But sometimes, when you have to make an urgent payment, and your Apple Pay is not working, there is nothing more frustrating than it. Apple Pay might have military-grade level security, but it is still prone to errors. However, […]

How to Fix WiFi Disappeared in Windows 11?

Users have complained that the WiFi symbol has disappeared from their taskbar after upgrading their PC to Windows 11. A network icon is present on the taskbar that displays network access. When your device doesn’t have the essential drivers installed, you will see an absent WiFi icon. Furthermore, if your computer’s WiFi adapter is deactivated […]

How to Fix Windows Update Service Not Running

The majority of Windows upgrades address security concerns. It is the most serious issue, as viruses or hackers might take advantage of them. Other flaws and concerns in Windows 10 can be resolved through updates. They may impact the sustainability of your OS, even if they are not accountable for security breaches. When you check […]